Fintech Lessons from Vietnam

Platforms, digital infrastructure, and growth beyond the core

I was recently invited to Vietnam by the Chairman of MB Bank, the leading bank in the country. Chairman Lưu Trung Thái brought me to Hanoi to meet with the bank’s leadership and speak about their ongoing digital transformation (DX) journey.

While there, I keynoted a large international conference, “Digitalize to Revolutionize,” that MB Bank hosted at the Lotte Hotel Hanoi.

Over the course of several meetings and site visits, I observed important lessons about digital financial services (“fintech”) in this rising Southeast Asian powerhouse.

Winning in a Highly Competitive Landscape

MB Bank has an impressive story.

It is a legacy bank with history as a state-sponsored enterprise, but it has embarked on a significant digital transformation during the last five years. This DX effort has enabled the bank to dramatically improve its market position, while dealing with both intense competition and national deficits in digital infrastructure.

Vietnam’s banking sector is dynamic and very competitive. The country has extremely high smartphone adoption (approaching 90% of adults) and growing penetration of banking services (75% of adults over 18). The competitive landscape in Vietnam has over a thousand banks, credit funds, and microfinance institutions.

Yet while the communist country now has a thriving private sector, and its startups attract overseas venture capital, Vietnam’s financial services industry is still constrained by limited digital infrastructure. In particular, there is a lack of credit scoring data and a national ID database. The costs of identity fraud put a ceiling on how quickly even the most innovative player can expand in the market. And the lack of credit scoring poses major challenges for underwriting loans.

Despite this, MB Bank has shown tremendous business results on its digital journey. In its first twenty years (out of twenty-nine), the bank acquired a total of 5 million customers. But in the last four years, it has added 20 million more customers, as MB reinvented itself as a digital-first bank. Under Chairman Thai’s leadership, MB rose from the middle of the pack to become the #1 retail bank in Vietnam.

How did MB Bank pull this off?

Platforms, Network Effects, and Competitive Advantage

Chairman Thai brought me to Hanoi specifically because he had read my 2016 book “The Digital Transformation Playbook” (a bestseller in its Vietnamese edition).

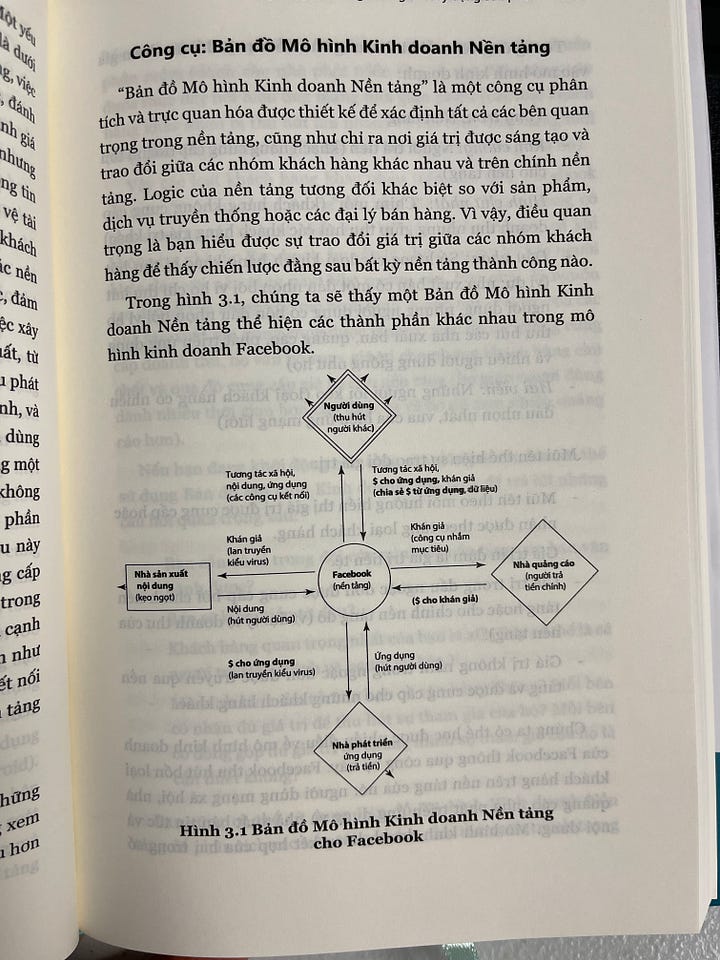

His leadership team had been particularly inspired by my writing on platform business models. In chapter 3 of that book, I provide an analysis of multi-sided business models and their impact on competitive strategy, along with a tool, the Platform Business Model Map.

MB Bank used these principles to create a “marketplace” inside its app—where the customer is connected not just to her MB Bank account, but to services from a range of partners in other industries.

In one seamless experience, customers can access all their banking, but also tax services, flight and hotel booking, electricity and water bills, and popular shopping sites.

With this value proposition—unmatched by other banks in Vietnam—MB’s app became the most downloaded in Apple’s App Store in Vietnam for 3 consecutive years.

Just as important, the app has recorded 20 million transactions per day, with MB Bank taking a cut of the net revenue earned by every partner in its marketplace.

This kind of business model innovation is especially critical for MB because barriers to competition are extremely low in retail banking in Vietnam. The average customer may hold five bank accounts at once (due to low “multi-homing costs”) and switch their money between them each month based on which bank is running a promotional offer.

With its platform business model, MB has finally been able to put up a competitive moat around its core business.

This moat comes from two kinds of cross-side network effects: First, customers have a unique reason to stay with MB Bank because of all the other businesses they can access via the MB super app. Second, as MB has built the most popular app and bank in Vietnam, it became the preferred choice for partner businesses looking to reach customers.

Examples from numerous industries have shown that these kinds of network effects are both extremely valuable and durable.

Bottom-Up Innovation

While I was speaking with a large forum of MB Bank employees, I was asked: “How do we encourage bottom-up thinking and innovation?”

In my talk, I had stressed the importance of bottom-up change to DX—that while leaders will define the overarching aims and strategy of the business (the “problems” it aims to solve)—everyone should be empowered to bring forward ideas for innovative solutions. (This is one of the repeated themes throughout my new book, “The Digital Transformation Roadmap.”)

We discussed an example of bottom-up thinking from MB Bank’s own recent marketing efforts. In Vietnam, numbers have connotations beyond the purely mathematical—lucky numbers or favorite numbers (the way I may have a favorite color).

One newly hired employee proposed an unusual idea: When opening a new account, why not let our customers pick their account number? Leaders signed off, and a new marketing campaign was launched promoting the chance for customers to pick their own account number. A few “very lucky” numbers were set aside for auction to the highest bidder.

The campaign was wildly successful, spurring growth in customer acquisition (especially among younger customers) and earning $40 million from auctioning the most coveted numbers.

As Head of Digital Banking, Mr. Vu Thanh Trung, described it to me: “The junior hire who proposed this was new to MB. They had little knowledge yet of our business, but they did have important insights into our customers!”

Growth Within the Core + Beyond the Core

While meeting with teams from across the company, I was impressed by MB’s focus on a multi-pronged approach to innovation:

Incremental innovations within the core banking business (like the account-numbers campaign).

New business models that add value to the core (like the marketplace within the MB app).

Innovation beyond the core, in non-banking financial services (like mobile payments, life and P&C insurance, and wealth management).

Some of the innovation beyond the core is being pursued through joint ventures with firms outside Vietnam (such as Aegeas or Shinsei Bank). Other innovation beyond the core is pursued through corporate venture capital, investing in or acquiring local startups. Still other new business models are being developed in a dedicated Innovation Lab.

I had a chance to visit MB Bank’s Innovation Lab, housed on a floor of the former headquarters building, and to meet with its leadership.

In the Lab, small, multi-functional teams are experimenting and testing a range of new ventures to solve customer and industry problems in life insurance, health insurance, real estate, and more. The Lab’s new ventures include analytics tools for small retailers, and a platform connecting Vietnamese charities with donors and volunteers.

The Lab’s work is organized around small teams with an interdisciplinary approach and diverse perspectives. Nearly half of the Lab’s employees are new hires from outside MB Bank.

Looking at MB’s innovation stack—with parallel structures pursuing incremental growth, new business models connected to the core, and growth beyond the core—it’s almost as if they had read my chapter on “The 3 Paths to Growth” in The Digital Transformation Roadmap, before it is published in Vietnamese next year!

***

Whether you’re in financial services yourself, or an entirely different sector, I hope you’re thinking about some of these same opportunities as you help push your own organizations towards ongoing digital transformation!

I’ll look forward to sharing more insights, and interviews with DX leaders, from my upcoming travels.

How Can We Help Your Business?

Please let me know if the David Rogers Group can help with the digital growth opportunity for your business.

How we work with clients

advisory & executive coaching for leadership teams

strategic workshops for business leaders or the board

training programs on digital transformation

conference keynotes

special projects

Common areas of focus:

defining a shared vision for digital

new ventures & business models for high-value growth

governance for rapid experimentation

managing innovation portfolios

digital mindset and culture change

To find out more, write to services@davidrogers.digital

Order today on Amazon.com

Hardcover https://amzn.to/41U85dl

Kindle https://amzn.to/3OWD437

Audiobook https://amzn.to/45Nhe8G

…and wherever books are sold!

Find out how to save on a bulk order for your team—a great end of year present!